Business Best Practices

New Laws Every Illinois Employer Needs to Know for 2024

Jun 7, 2023

Illinois Laws

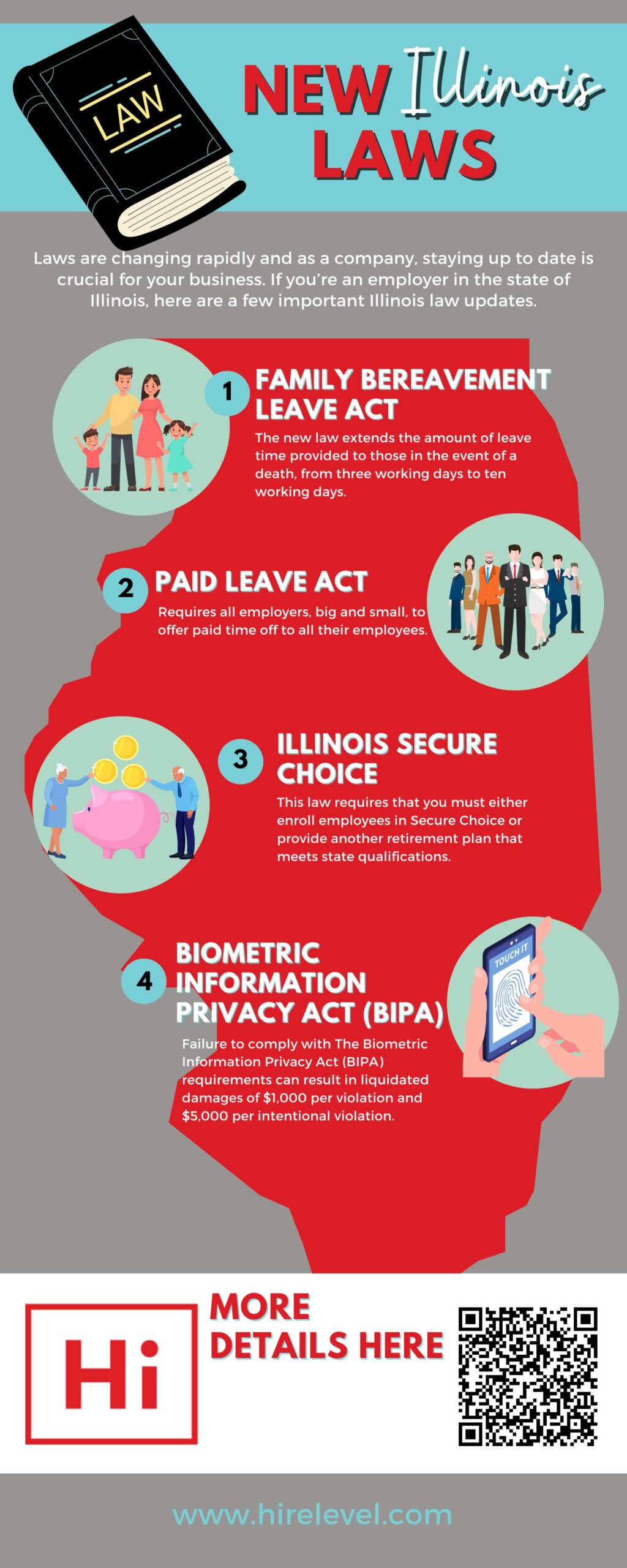

It’s happening whether we like it or not, laws are changing rapidly and as a company, staying up to date will benefit you in the long run. If you’re an employer in the state of Illinois, those changes include some laws you might be unaware of and could affect your business drastically. But no fear! HireLevel is here to keep you on track and compliant with the changes ahead!

So, what are the new laws in Illinois?

What is the new Family Bereavement Leave Act law in Illinois?

First up, a change that has already gone into effect that extends bereavement coverage. The state of Illinois has updated the former Child Bereavement Leave Act to the new and improved Family Bereavement Leave Act, or FBLA for short. The new law extends the amount of leave time provided to those in the event of a death, from three working days to ten working days.

The new law also updates the term “child” and replaces it to grief of “any covered family member”. So, who is now considered a covered family member?

The new law also extends bereavement leave to those who have suffered a miscarriage, went through an unsuccessful round of in vitro, had a failed adoption, failed surrogacy agreement, a diagnosis that negatively impacts pregnancy or fertility, or a stillbirth.

Now, the law remains that leave may still be unpaid and available after 12 months of employment and to employees who have worked at least 1,250 hours within the previous 12 months. Since this is part of the state’s Family Medical Leave Act, keep in mind that if the employee has exhausted their FMLA allowance, then the FBLA leave does not grant an additional allowance.

What is the new Illinois Paid Leave for All Workers Act?

This next law requires all employers, big and small, to offer paid time off to all their employees. It’s called the Illinois Paid Leave Act. This is a law we expect to see gain popularity across the country in the coming years and be adopted by other states. So how much time are employers required to provide employees? The short answer is up to 40 hours. Obviously, you can offer more if you’d like, but if you’re here for the guidelines on what is required, let’s break it down.

First, there are two separate ways an employer can decide to distribute PTO. The first is to frontload the 40 hours to the employee at the beginning of the year or at the start of employment. The second option is that the employer can set an accrual rate at a minimum of 1 hour accrued for every 40 hours of work until the employee accrues 40 hours within the year.

If the employer frontloads PTO, the employer can enforce a “use it or lose it” policy. Meaning if the hours are not used by the end of the year, they are gone. On the other hand, an employer who sets an accrual rate must allow the unused hours to roll over into the next plan year, allowing those hours to never expire.

Regardless of how the employer chooses to distribute PTO, the employee starts accruing hours from the first day of employment but must wait until they hit 90 days before they are allowed to use any of the time.

If at any time, the employee separates from the company for any reason, unused time does not have to be paid out to the employee. Now, if that employee chooses to come back, and separation has been less than 12 months, the employer is to reinstate the previously accrued and unused time to be available to the employee at the beginning of re-employment.

The law states that employers can write their policy to require employees to take a minimum of two hours of leave at one time and provide a 7-day notice for leave that is considered foreseeable. Employers cannot require employees to provide documentation to use PTO.

Recordkeeping is key here. Employers will need to keep a record of each employee’s hours worked, paid leave accrued and taken, and the remaining paid leave balance for at least three years. Upon request, employers should be prepared to provide employees with an updated and accurate PTO balance. Employees have up to 3 years to file a complaint with the Illinois Department of Labor and violations can earn a fine up to $2,500 per offense.

At HireLevel, we can keep your business in compliance with PTO tracking through our leave management software. Our timekeeping software can turn time-consuming processes into streamlined, efficient, and compliant business practices that will allow you to focus on the important items that need your attention the most. We will be with you every step of the way to ensure your correct time-tracking policies are set up during implementation to get you off to a great start. Our solution is the perfect fit for businesses of any size and can grow with you!

What is the new Illinois secure choice law?

The state of Illinois has also put a plan in place to assist employees with retirement. This plan, Illinois Secure Choice, isn’t new. It has been in place for large employers (over 500) since 2018. Every year since, the employee threshold has gotten lower and lower. In November of 2023, that threshold will drop again to include employers that have 5 or more employees.

So, what is Illinois Secure Choice? It’s a retirement savings program for employers who do not already offer a plan to their employees. This program is part of a larger statewide retirement mandate. It requires that you must either enroll employees in Secure Choice or provide another retirement plan that meets state qualifications.

Why is the state taking an interest in setting up retirement plans? Studies have shown that many employees do not have retirement savings through their employers and will not have the funds needed to retire. Illinois is just one of many states that have passed legislation that makes it imperative to find a cost-effective solution for your team.

As an employer who chooses to use Illinois Secure Choice as your retirement plan, you are required to facilitate the program. That includes registering and providing employee data with the state as well as providing program materials to all employees and setting them up with the proper payroll deduction. The enrollment deadline is September 1st, 2023. Companies that are not in compliance will face a $250 fine per employee. With that amount doubling to $500 per employee each year after.

Keep in mind, we all know that retention of talent is a must, and prioritizing retirement benefits is one of the boxes that must be checked when looking to recruit and retain top talent. Candidates are heavily considering what employers are offering when searching for their next career move.

At HireLevel, we can take the hassle out of managing your 401(k). Our software allows us the automation to make vendor payments every pay period and ensure that compliance and the paperwork is out of your hands. Our 401(k) solution is completely integrated with payroll and can completely streamline enrollment, contributions, and take the manual work out of providing a great benefit to your team.

What is the new BIPPA law in Illinois?

Last, but not least is the Illinois Biometric Information Privacy Act (BIPPA). It seems like a secure, fraud-proof, and maybe even harmless way to allow employees to clock in and out by using their fingerprints or a scan of their eye, or even a voiceprint for verification. If this is something your company is using or even considering, you might want to think again.

Otherwise known as a “biometric identifier”, a voiceprint, retina, iris scan, fingerprint, or scan of hand or face geometry, has all gained popularity among employers over the last couple of years. But a collection of this biometric data is now being reevaluated thanks to the Illinois Biometric Information Privacy Act, otherwise known as BIPPA.

As an employer, here are some things to know:

Failure to comply with The Biometric Information Privacy Act (BIPA) requirements can result in liquidated damages of $1,000 per violation and $5,000 per intentional violation.

You should think through how these new laws make sense for your workforce and educate yourself on any upcoming changes in federal and state laws regarding your business.

If you have questions about any of the information that you read today, reach out to our team here.

Here at HireLevel, we want to be your resource for all things HR compliance.